Propel provides innovative insurance solutions to thousands of companies across the country. We make it our business to know your world inside and out.

Property, Small Business

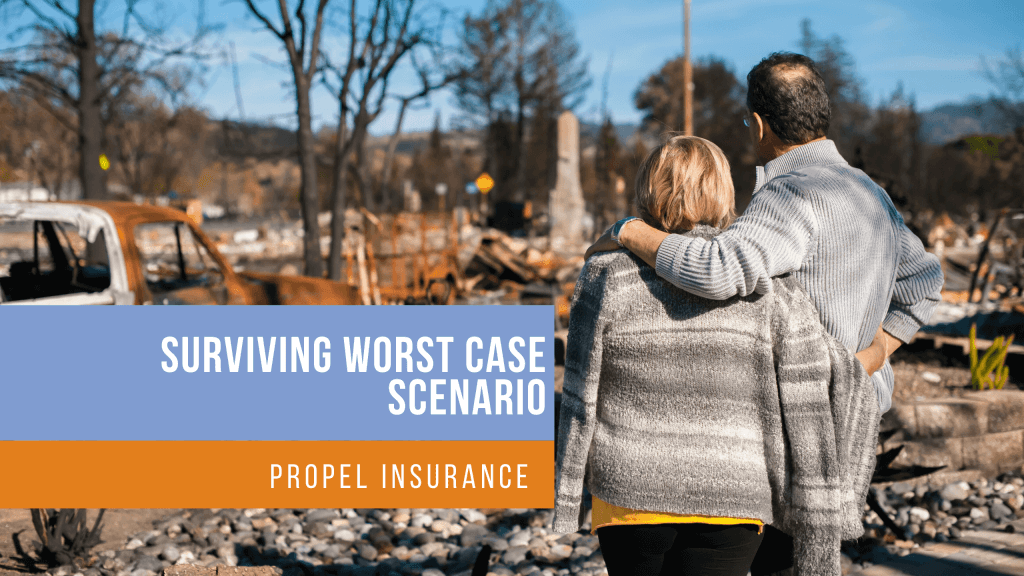

Surviving a Worst-Case Scenario

When natural disaster strikes, fire and flooding may be the most obvious impacts to a business, but the indirect impacts could be just as damaging. Is your business prepared for a worst-case scenario?

What if your employees can’t get to work? What if your supply chain is grounded? And, in the aftermath of something like an earthquake, how will you make up for lost revenue?

With a business continuity plan, you can set up procedures to maintain or resume business after a devastating event, including:

- determining an alternate work site;

- having a way to immediately contact employees if power sources are down;

- and establishing a Plan B for every link in your supply chain.

Also, talk with your broker about business interruption insurance – both direct and contingent – which can cover lost revenue and operating expenses after a disaster.

Learn more about protecting your business from a worst-case scenario here.